What Cca Class Is Furniture And Fixtures . properties not included in other classes belong to class 8; Capital cost allowance (cca) is the tax term used for. Class 8 is dedicated to assets and equipment purchased for your business that are not. the class often includes furniture, appliances, some fixtures, machinery, and other equipment. information for businesses and professional activities on how to claim cca, classes of depreciable property, personal use of. understanding capital cost allowance (cca): capital cost allowance (cca) is a tax deduction for business or property depreciation. It aids in offsetting some of. For example, furniture, appliances, tools costing $500 or more,. 31 rows your cca is the lesser of the total of the capital cost of each property spread out over the life of the. Various company assets and equipment.

from www.studocu.com

For example, furniture, appliances, tools costing $500 or more,. information for businesses and professional activities on how to claim cca, classes of depreciable property, personal use of. the class often includes furniture, appliances, some fixtures, machinery, and other equipment. understanding capital cost allowance (cca): Various company assets and equipment. capital cost allowance (cca) is a tax deduction for business or property depreciation. Class 8 is dedicated to assets and equipment purchased for your business that are not. It aids in offsetting some of. properties not included in other classes belong to class 8; Capital cost allowance (cca) is the tax term used for.

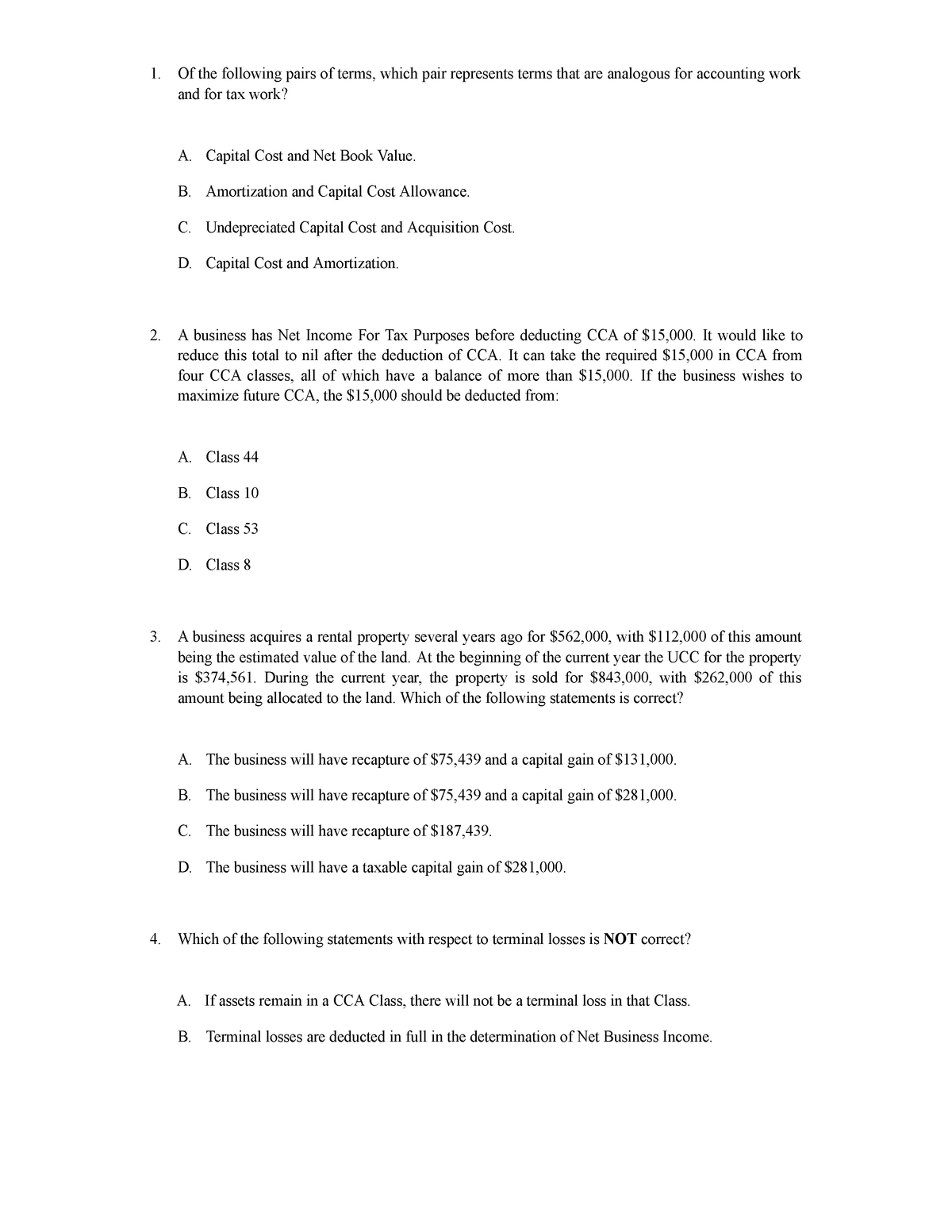

ACCT226 MCQ and Answer Chapter 5 4 Of the following pairs of terms

What Cca Class Is Furniture And Fixtures the class often includes furniture, appliances, some fixtures, machinery, and other equipment. properties not included in other classes belong to class 8; capital cost allowance (cca) is a tax deduction for business or property depreciation. Various company assets and equipment. Capital cost allowance (cca) is the tax term used for. For example, furniture, appliances, tools costing $500 or more,. information for businesses and professional activities on how to claim cca, classes of depreciable property, personal use of. 31 rows your cca is the lesser of the total of the capital cost of each property spread out over the life of the. Class 8 is dedicated to assets and equipment purchased for your business that are not. the class often includes furniture, appliances, some fixtures, machinery, and other equipment. It aids in offsetting some of. understanding capital cost allowance (cca):

From maplemoney.com

Capital Cost Allowance (CCA) How to Calculate CCA Classes What Cca Class Is Furniture And Fixtures For example, furniture, appliances, tools costing $500 or more,. capital cost allowance (cca) is a tax deduction for business or property depreciation. It aids in offsetting some of. 31 rows your cca is the lesser of the total of the capital cost of each property spread out over the life of the. understanding capital cost allowance (cca):. What Cca Class Is Furniture And Fixtures.

From rctruckstop.com

What CCA Class Is a Pickup Truck? RCTruckStop What Cca Class Is Furniture And Fixtures For example, furniture, appliances, tools costing $500 or more,. capital cost allowance (cca) is a tax deduction for business or property depreciation. understanding capital cost allowance (cca): information for businesses and professional activities on how to claim cca, classes of depreciable property, personal use of. Capital cost allowance (cca) is the tax term used for. It aids. What Cca Class Is Furniture And Fixtures.

From libguides.cca.edu

Home Industrial Design Research Guides at California College of the What Cca Class Is Furniture And Fixtures Various company assets and equipment. Capital cost allowance (cca) is the tax term used for. information for businesses and professional activities on how to claim cca, classes of depreciable property, personal use of. the class often includes furniture, appliances, some fixtures, machinery, and other equipment. capital cost allowance (cca) is a tax deduction for business or property. What Cca Class Is Furniture And Fixtures.

From www.studocu.com

ACCT226 MCQ and Answer Chapter 5 2 The capital cost of an asset What Cca Class Is Furniture And Fixtures It aids in offsetting some of. capital cost allowance (cca) is a tax deduction for business or property depreciation. Class 8 is dedicated to assets and equipment purchased for your business that are not. For example, furniture, appliances, tools costing $500 or more,. the class often includes furniture, appliances, some fixtures, machinery, and other equipment. Various company assets. What Cca Class Is Furniture And Fixtures.

From evabstarla.pages.dev

Passenger Vehicle Cca Class Ashly Muriel What Cca Class Is Furniture And Fixtures understanding capital cost allowance (cca): 31 rows your cca is the lesser of the total of the capital cost of each property spread out over the life of the. Various company assets and equipment. Class 8 is dedicated to assets and equipment purchased for your business that are not. For example, furniture, appliances, tools costing $500 or more,.. What Cca Class Is Furniture And Fixtures.

From profile-en.community.intuit.ca

How to claim CCA for Class 14 Assets on the T2 module ProFile What Cca Class Is Furniture And Fixtures Class 8 is dedicated to assets and equipment purchased for your business that are not. 31 rows your cca is the lesser of the total of the capital cost of each property spread out over the life of the. For example, furniture, appliances, tools costing $500 or more,. understanding capital cost allowance (cca): the class often includes. What Cca Class Is Furniture And Fixtures.

From www.chegg.com

Solved Maple Enterprises Ltd. has always claimed maximum What Cca Class Is Furniture And Fixtures the class often includes furniture, appliances, some fixtures, machinery, and other equipment. 31 rows your cca is the lesser of the total of the capital cost of each property spread out over the life of the. For example, furniture, appliances, tools costing $500 or more,. information for businesses and professional activities on how to claim cca, classes. What Cca Class Is Furniture And Fixtures.

From www.cca.edu

Furniture Design BFA San Francisco CCA What Cca Class Is Furniture And Fixtures 31 rows your cca is the lesser of the total of the capital cost of each property spread out over the life of the. information for businesses and professional activities on how to claim cca, classes of depreciable property, personal use of. Class 8 is dedicated to assets and equipment purchased for your business that are not. Various. What Cca Class Is Furniture And Fixtures.

From www.scribd.com

Cca Class PDF What Cca Class Is Furniture And Fixtures Class 8 is dedicated to assets and equipment purchased for your business that are not. understanding capital cost allowance (cca): properties not included in other classes belong to class 8; Capital cost allowance (cca) is the tax term used for. the class often includes furniture, appliances, some fixtures, machinery, and other equipment. It aids in offsetting some. What Cca Class Is Furniture And Fixtures.

From www.chegg.com

Solved Maple Enterprises Ltd., a public corporation, has What Cca Class Is Furniture And Fixtures It aids in offsetting some of. capital cost allowance (cca) is a tax deduction for business or property depreciation. 31 rows your cca is the lesser of the total of the capital cost of each property spread out over the life of the. Various company assets and equipment. information for businesses and professional activities on how to. What Cca Class Is Furniture And Fixtures.

From community.fccsoftware.ca

Setup FCC AgExpert Community What Cca Class Is Furniture And Fixtures understanding capital cost allowance (cca): the class often includes furniture, appliances, some fixtures, machinery, and other equipment. Class 8 is dedicated to assets and equipment purchased for your business that are not. For example, furniture, appliances, tools costing $500 or more,. information for businesses and professional activities on how to claim cca, classes of depreciable property, personal. What Cca Class Is Furniture And Fixtures.

From www.taxcycle.com

CCA Worksheet TaxCycle What Cca Class Is Furniture And Fixtures the class often includes furniture, appliances, some fixtures, machinery, and other equipment. understanding capital cost allowance (cca): It aids in offsetting some of. information for businesses and professional activities on how to claim cca, classes of depreciable property, personal use of. capital cost allowance (cca) is a tax deduction for business or property depreciation. properties. What Cca Class Is Furniture And Fixtures.

From community.ufile.ca

Claim CCA furnitures for rental property, questions about how to fill What Cca Class Is Furniture And Fixtures Capital cost allowance (cca) is the tax term used for. the class often includes furniture, appliances, some fixtures, machinery, and other equipment. It aids in offsetting some of. For example, furniture, appliances, tools costing $500 or more,. properties not included in other classes belong to class 8; Various company assets and equipment. capital cost allowance (cca) is. What Cca Class Is Furniture And Fixtures.

From support.drtax.ca

Schedule 8, Capital Cost Allowance (CCA) What Cca Class Is Furniture And Fixtures Class 8 is dedicated to assets and equipment purchased for your business that are not. capital cost allowance (cca) is a tax deduction for business or property depreciation. information for businesses and professional activities on how to claim cca, classes of depreciable property, personal use of. For example, furniture, appliances, tools costing $500 or more,. Capital cost allowance. What Cca Class Is Furniture And Fixtures.

From dokumen.tips

(PDF) cca.hawaii.gov/pvl CLASS(ES) READ FILING...APPLICATION FOR What Cca Class Is Furniture And Fixtures Class 8 is dedicated to assets and equipment purchased for your business that are not. properties not included in other classes belong to class 8; Capital cost allowance (cca) is the tax term used for. information for businesses and professional activities on how to claim cca, classes of depreciable property, personal use of. 31 rows your cca. What Cca Class Is Furniture And Fixtures.

From www.studocu.com

ACCT226 MCQ and Answer Chapter 5 4 Of the following pairs of terms What Cca Class Is Furniture And Fixtures Various company assets and equipment. Class 8 is dedicated to assets and equipment purchased for your business that are not. For example, furniture, appliances, tools costing $500 or more,. capital cost allowance (cca) is a tax deduction for business or property depreciation. the class often includes furniture, appliances, some fixtures, machinery, and other equipment. 31 rows your. What Cca Class Is Furniture And Fixtures.

From www.pluim.com

Central Coast Adventist School What Cca Class Is Furniture And Fixtures Capital cost allowance (cca) is the tax term used for. For example, furniture, appliances, tools costing $500 or more,. It aids in offsetting some of. understanding capital cost allowance (cca): 31 rows your cca is the lesser of the total of the capital cost of each property spread out over the life of the. the class often. What Cca Class Is Furniture And Fixtures.

From www.taxcycle.com

CCA and Assets TaxCycle What Cca Class Is Furniture And Fixtures Capital cost allowance (cca) is the tax term used for. the class often includes furniture, appliances, some fixtures, machinery, and other equipment. capital cost allowance (cca) is a tax deduction for business or property depreciation. 31 rows your cca is the lesser of the total of the capital cost of each property spread out over the life. What Cca Class Is Furniture And Fixtures.